A credit score is one of the most important parameters to judge the creditworthiness of a borrower. All reputed banking and non-banking financial institutions ask for a credit score from the borrower before processing their loan application. It is safer for financial institutions to lend money to individuals with a good credit score as they are less likely to default on their loan repayments. Borrowers who have a poor credit score are highly likely to default on their bill payments given their past track record. A credit score test is like a litmus test for lending institutions. One can easily make a credit score check online before opting for a loan to have a better idea.

What exactly is a credit score?

The credit score can be defined as a numerical expression that quantifies a person’s creditworthiness based on a thorough analysis of their credit history. A credit score is obtained after proper evaluation of the subject’s credit report from recognised and reputed credit bureaus. The credit history of the individual takes into account important factors like the number of open accounts, total debt, loan repayment history, etc. A credit score sums up all these factors into a quantifiable figure that makes it easy for organisations to decide whether to lend money or not.

What constitutes a good credit score?

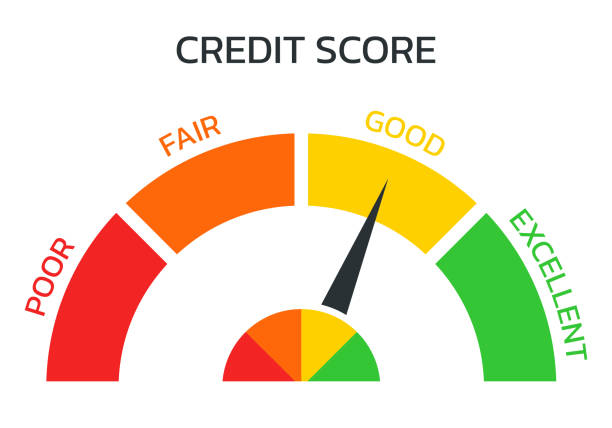

As mentioned earlier, most organisations check credit scores before lending money to applicants. This helps them weed out the bad borrowers and lend money to individuals with good credit histories. The risk appetite for different lending parties can vary depending on their past experiences. However, there is a consensus among all financial institutions as to what constitutes a good credit score. A credit score is a 3-digit number in the range of 300 to 900 that explains your creditworthiness to the lender and plays a crucial role in getting personal and home loan approval. The higher the score the better an individual’s creditworthiness. A credit score between 700 and 750 is considered as good, a score between 750 to 800 is considered as very good. Any score above 800 is considered excellent by lending institutions.

How is credit score calculated?

A credit score is calculated by credit bureaus in a country, it helps lending institutions to make an easy decision when it comes to lending credit. Several factors are included in the calculation of an individual’s credit history. Let’s take a look at these factors and the intensity of their impact on credit score calculation.

Payment history

One of the most important factors that affect an individual’s credit score is their payment history. When you are consistent with your credit card bill payments, loans and EMIs, you have a good repayment track record. It helps to prove the fact that you are a responsible borrower who is not likely to default on the bill payments. This will also help to make you eligible for a better rate of interest on loans and quick loan processing. The impact level of payment history is high in credit score computation.

Credit utilisation ratio

The second most important factor when it comes to credit score computation is the credit utilisation ratio. The credit utilisation ratio is computed by dividing the amount of credit that you have borrowed by the amount of credit you have access to. Suppose that you own a credit card that has a limit of INR 1,00,000 and you have used 50,000 in the last month, this means that your credit utilisation ratio is equal to 1:2 (50%). As per credit experts, consumers should only use 30 to 40% of their credit limit to maintain a higher credit score. The impact of credit utilization ratio is high.

Age of the credit

Another important factor that is taken into account while computing your credit score is the age of your credit. Having an old credit history is preferred, it will add positively to your overall credit score. Long credit history will help to instil trust among your lenders. Lenders find it hard to lend money to those who don’t have a credit history and are new to the system. The age of credit holds a medium impact on your credit card score.

Total accounts

The total number of credit accounts you have also have an impact on your credit score. However, this impact is not very significant. Maintaining a good balance of secured as well as an unsecured line of credit has a positive effect on your credit score. A credit mix can help to increase your overall credit score.

Tips to improve your credit score

Improving your credit score has a lot of benefits when it comes to getting a loan from reputed financial institutions. It can help you get better terms and conditions on your loan along with low-interest rates. Here are some pragmatic tips to improve your credit score easily.

Timely repayment

Your payment history has a huge impact on your credit score. Paying your credit card bills, EMI and loans on time are crucial if you are looking to boost your credit score. Keeping a track of your credit bill payment dates is important for timely repayment.

A good credit mix

A good credit mix that has both secured and unsecured credit lines can help to improve your credit score. You should aim to diversify your credit lines instead of obtaining a higher amount from the same source.

Choose long term loans

Whenever you take a loan for meeting any financial obligations, always go for a longer loan tenure. Longer loan tenure can help to reduce your EMI amount and you’ll be easily able to pay this off without any risk of default.

Check for errors in your credit report and rectify it

Always conduct a credit score check online and study your credit report to find any errors. If you spot any errors in your credit report, always report it to the bureau and rectify the same as soon as possible.

One can easily check credit score for free online on Clix Capital’s website before applying for a loan. It offers an array of loans for diverse needs which are disbursed instantly without any complex documentation. Apply for a loan today with Clix Capital and get the best interest rate!

For any queries, find us on Facebook, Instagram, LinkedIn, Twitter, or WhatsApp

You can also reach out to us at hello@clix.capital or call us at 1800 200 9898