Does the term pre-approved loans sound familiar to you? It’s very possible that this might be the case – after all, you would most likely have received an email or SMS from a financial institution at some point in your life congratulating you on your eligibility for a pre-approved loan. If you have been told that you’re eligible for a pre-approved loan, then it implies any one of the following things – either you hold a sound financial record, have a good relationship with your financial institution, or are truly creditworthy. Whatever the case might be, it’s a prodigious thing that you’ve been shortlisted for a pre-approved loan.

However, before we get into the meat of this topic, there are few basics that need to be fleshed out first.

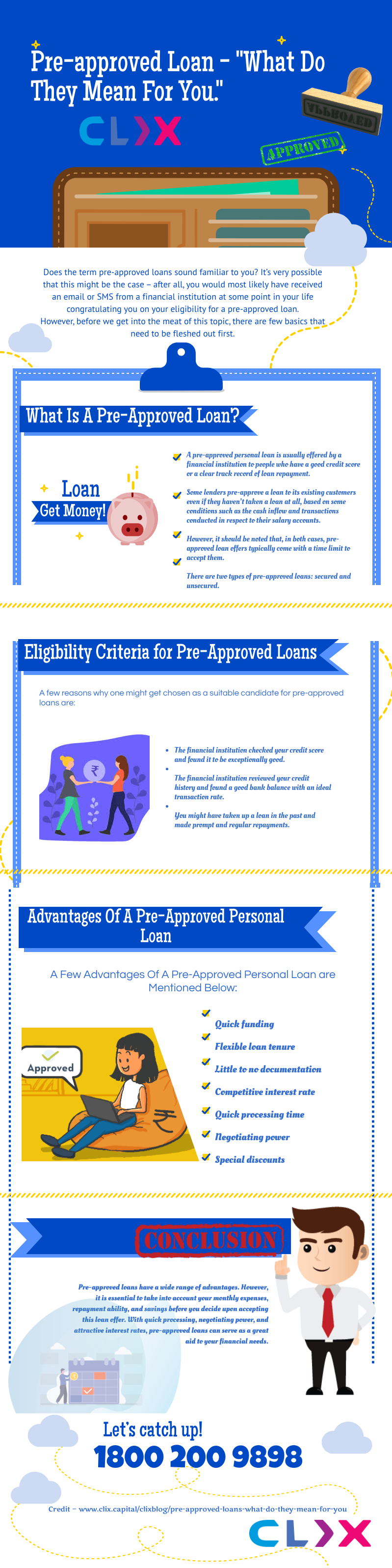

What is a Pre-Approved Loan?

A pre-approved loan is usually offered by financial institutions to people who have a clear track record of loan repayment (ideally with the financial institution itself). Some lenders pre-approve a loan to its existing customers even if they haven’t taken a loan at all, based on some conditions such as the cash inflow and transactions conducted in respect to their salary accounts. However, it should be noted that, in both cases, pre-approved loan offers typically come with a time limit to accept them.

There are two types of pre-approved loans: secured and unsecured. Secured loans comprise of car loans or even home loans, while unsecured pre-approved loans comprise of mainly credit cards and personal loans.

Eligibility Criteria For Pre-Approved Loans

Typically, a financial institution judges your eligibility before offering a pre-approved loan, which is mainly based on your track record or CIBIL score. The lender carries out an analysis of the individual’s credit score, financial standing, and credibility. Based on this analysis, they offer a customised pre-approved loan.

A few reasons why one might get chosen as a suitable candidate for pre-approved loans are:

- The financial institution checked your credit score and found it to be exceptionally good.

- The financial institution reviewed your credit history and found a good bank balance with an ideal transaction rate.

- You might have taken up a loan in the past and made prompt and regular repayments.

Are Pre-Qualification and Pre-Approval the same thing?

Most people have wrongfully assumed that the terms pre-qualification and pre-approval mean the same thing, with the only difference resting in the terminology. While this might be partly true, there are still several major factors that differentiate pre-qualification and pre-approval.

The prequalification of a loan does not guarantee you a loan and is, in fact, the initial stage of applying for a loan. In this stage, you present your documents to the lender and can proceed to the loan application stage if you manage to convince them. The next stage is pre-approved loans, where you need to pay the application fees and go through a verification process as well.

In the case of pre-qualification, the applicant and the lender have a verbal discussion wherein the lender requests financial details like the credit history and income of the buyer. In the case of pre-approval, the financial lender carries out a comprehensive verification of the buyer’s credit score, income, monthly net income, debt-to-income ratio, and so on. The lender goes through a thorough background check of the buyer’s details before signing off on the approval of said loan.

It is also important to observe that the bank is not obligated to approve your loan request even after you claim a pre-approval or pre-qualification letter. While it’s definitely true that you have the upper hand in this situation, do keep in mind that the financial institution needs to take several factors into account before disbursing your loan. If too many of these factors are out of sync, then the lender has every right to reject the loan application.

What documents are required for availing pre-approved loans?

Generally speaking, the documentation required for most loans are as follows:

- Completed application form, as provided by the financial institution

- Passport size photograph

- ID Proof

- Address Proof

- Income Proof

Pre-approved loans are offered by financial institutions to their existing customers. Since these customers have already gone through a comprehensive background check, the approval process is much quicker and simplifies the documentation process to a great extent. Hence, the level of scrutiny when it comes to the documentation of these loans is not as stringent as it might be otherwise. At Clix Capital, we’re not going to bother you with the loan process again and would only require a few documents for a smooth application process: some of which include bank statements, salary slips for the last 3 months, proof of identity and PAN.

Advantages of a pre-approved personal loan

With a sound financial record comes the offer of a pre-approved loan, which has a variety of benefits in store for you. A few of these are mentioned below:

- Quick funding: Whenever you require urgent funding to meet your financial needs, being eligible for a pre-approved loan can serve as a safety net. The loan typically gets approved and disbursed on the same day within a few minutes, once the verification process is successful.

- Flexible loan tenure: One has the option to choose a repayment plan that is suitable for them. Consider your repayment capability while choosing the loan tenure so that you don’t default on the repayment.

- Little to no documentation: If you’re an existing customer who is eligible for a pre-approved loan, you don’t have to worry about your documentation. For the most part, the financial institution will already have your income details and other documents in their database.

- Competitive interest rate: Being eligible for a pre-approved loan is indicative of a good credit history. Your clean record represents your financial discipline and, hence, the lender can offer you a loan at competitive interest rates.

- Quick processing time: Since you have already passed the eligibility criteria for the pre-approved loan, you will not be subjected to any scrutiny. The loan can be easily disbursed within a day.

- Negotiating power: In a pre-approved loan, the financial institution typically approaches you instead of the other way around. This means that you are in a better position to negotiate the terms of the loan agreement.

- Special discounts: When you’re eligible for a pre-approved loan, it implies that you have a good history with the financial institution. Due to this reason, you can be provided with special discounts and benefits that regular customers won’t be availing.

Things to keep in mind about pre-approved loans

While there are a lot of advantages of pre-approved loans, you still need to keep certain things in mind before proceeding with the loan application. Questions like ‘Do I really need a loan right now?’, ‘Will it affect my credit score?’, ‘Will it impact my budget?’, ‘Are there any hidden conditions and costs?’, and ‘Is this the best rate I can get?’ are important queries that need to be addressed. Consider the following points before going ahead with your pre-approved loan offer.

- First and foremost, ask yourself if you really need it. Do not avail any loan just because it is offered to you. Though it is pre-approved with minimum hassle, it still carries the obligation of monthly instalments, which is an additional financial burden that you might not afford to bear. Thus, it’s a wise call to avail a loan only when you really need it.

- The repayment period is an important thing to consider before saying yes to a pre-approved loan. Ensure that you’re able to make regular repayments that adhere to the terms of the loan agreement to avoid paying any late fees.

- A financial institution is not legally bound to sanction the pre-approved loan once it makes a proposal for the same. In fact, if any discrepancy is found in the credit score or documentation, the application can be rejected outright. The term “pre-approved” signifies a person’s eligibility for the loan, and not instant approval or disbursement.

- Pre-approved loans typically have a time limit before the offer expires. If you really want the loan after thorough research, then you should act quickly… and wisely.

- Make sure to check the interest rate for regular loans before accepting a pre-approved loan. While it is highly likely that the interest rate on the loan that is sanctioned is 1-2% less than market rates, some financial institutions can increase the rate for pre-approved customers.

- Before signing the deal, look out for prepayment fees and other such charges. Some financial institutions might charge an additional processing fee on such loans or put a high penalty on foreclosures as well, so make sure you’ve read the paperwork to carry out an informed decision.

Some Frequently Asked Questions

How important is my credit score in determining my chance to avail a pre-approved loan?

In one word, ‘very.’ All financial lenders base their decisions on your credit score. The better track record you have, the higher your chance of getting a pre-approved loan.

I was pre-approved but then rejected. What happened?

The main cause could be a significant change in your financial situation, such as a job loss or job change. it could even be hefty purchases and credit commitments after pre-approval. In certain cases, it is also possible that the lender’s qualification criteria has changed as well.

What happens after I get pre-approved?

Your financial lender will likely contact you to confirm the information that you have submitted if you are pre-approved for a loan. After this, the lender might take a day to fully underwrite your loan application, after which you will be receiving an official approval for the same.

In conclusion, pre-approved loans have a wide range of advantages. However, it is very much essential to take into account your monthly expenses, repayment ability, and savings before you decide upon accepting this loan offer. With quick processing, negotiating power, and attractive interest rates, pre-approved loans can serve as a great aid to your financial needs.